Bond Portfolio Management Using The Dynamic Nelson-Siegel Model . In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. As shown by diebold and li (2006), a suitably dynamized. As a main feature of our analysis, we use. In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. To estimate the model, we.

from www.slideshare.net

To estimate the model, we. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. As a main feature of our analysis, we use. In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. As shown by diebold and li (2006), a suitably dynamized.

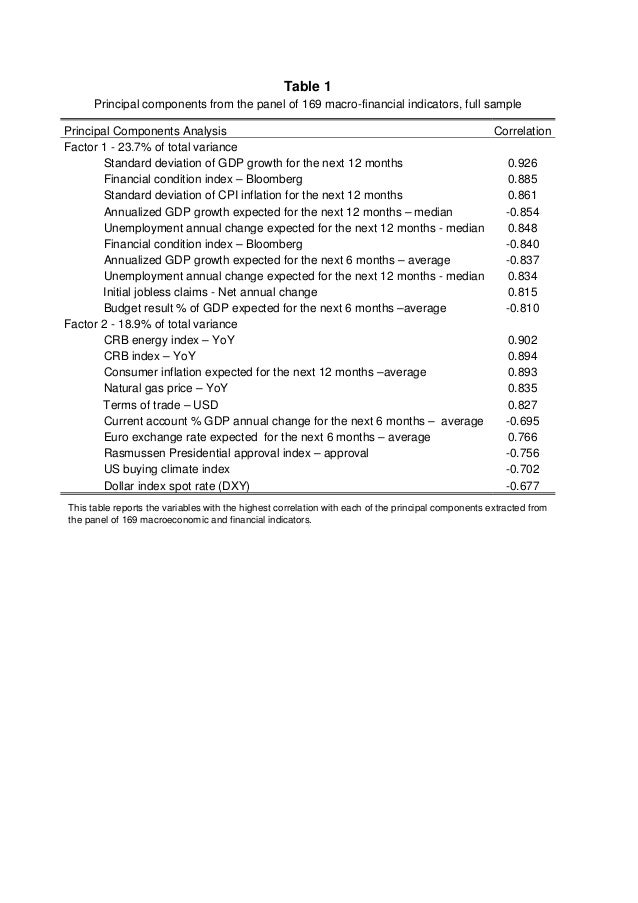

A dynamic NelsonSiegel model with forwardlooking indicators for the…

Bond Portfolio Management Using The Dynamic Nelson-Siegel Model To estimate the model, we. In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. As shown by diebold and li (2006), a suitably dynamized. As a main feature of our analysis, we use. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. To estimate the model, we.

From www.researchgate.net

(PDF) Modeling NelsonSiegel Yield Curve using Bayesian Approach Bond Portfolio Management Using The Dynamic Nelson-Siegel Model In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. As shown by diebold and li (2006), a suitably dynamized. In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. To estimate the model, we. In this. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.semanticscholar.org

Figure 1 from Bond Portfolio Management Using the Dynamic NelsonSiegel Bond Portfolio Management Using The Dynamic Nelson-Siegel Model As shown by diebold and li (2006), a suitably dynamized. In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. As a main feature of our analysis,. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.slideshare.net

A dynamic NelsonSiegel model with forwardlooking indicators for the… Bond Portfolio Management Using The Dynamic Nelson-Siegel Model In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. As a main feature of our analysis, we use. To estimate the model, we. As shown by diebold and li (2006), a suitably dynamized. In this paper we survey a number of recent empirical ndings regarding the usefulness of. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.semanticscholar.org

[PDF] A dynamic NelsonSiegel yield curve model with Markov switching Bond Portfolio Management Using The Dynamic Nelson-Siegel Model To estimate the model, we. As shown by diebold and li (2006), a suitably dynamized. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. As a main feature of our analysis, we use. In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson.. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.researchgate.net

(PDF) 'Forecasting multiple time series using quasirandomized neural Bond Portfolio Management Using The Dynamic Nelson-Siegel Model In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. As shown by. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.semanticscholar.org

Figure 1 from The Dynamic NelsonSiegel Model with TimeVarying Bond Portfolio Management Using The Dynamic Nelson-Siegel Model As shown by diebold and li (2006), a suitably dynamized. As a main feature of our analysis, we use. To estimate the model, we. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. In. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.semanticscholar.org

Table 1 from The Dynamic NelsonSiegel Model with TimeVarying Loadings Bond Portfolio Management Using The Dynamic Nelson-Siegel Model As a main feature of our analysis, we use. As shown by diebold and li (2006), a suitably dynamized. In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. To estimate the model, we. In this paper we present a multiple period bond portfolio model and suggest a. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From economics.sas.upenn.edu

Yield Curve Modeling and Forecasting The Dynamic NelsonSiegel Bond Portfolio Management Using The Dynamic Nelson-Siegel Model To estimate the model, we. In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. As a main feature of our analysis, we use. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. As shown by diebold and li (2006), a suitably dynamized. In. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.slideshare.net

A dynamic NelsonSiegel model with forwardlooking indicators for the… Bond Portfolio Management Using The Dynamic Nelson-Siegel Model As a main feature of our analysis, we use. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. As shown by diebold and li (2006), a suitably dynamized. In this paper we present. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.slideshare.net

A dynamic NelsonSiegel model with forwardlooking indicators for the… Bond Portfolio Management Using The Dynamic Nelson-Siegel Model In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. As a main feature of our analysis, we use. In this paper we survey a number of recent empirical ndings regarding the usefulness of including. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.slideshare.net

A dynamic NelsonSiegel model with forwardlooking indicators for the… Bond Portfolio Management Using The Dynamic Nelson-Siegel Model To estimate the model, we. In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. In this paper, we apply markowitzs approach of portfolio selection to government. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.semanticscholar.org

Figure 3 from The Dynamic NelsonSiegel Model with TimeVarying Bond Portfolio Management Using The Dynamic Nelson-Siegel Model In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. As a main feature of our analysis, we use. In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. To estimate the model, we. In this paper,. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.slideserve.com

PPT NelsonSiegel Svensson model application for Swedish government Bond Portfolio Management Using The Dynamic Nelson-Siegel Model In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. As a main feature of our analysis, we use. As shown by diebold and li (2006), a suitably dynamized. To estimate the model, we.. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From blog.deriscope.com

Parametric Yield Curve Fitting to Bond Prices under constraints The Bond Portfolio Management Using The Dynamic Nelson-Siegel Model To estimate the model, we. As a main feature of our analysis, we use. As shown by diebold and li (2006), a suitably dynamized. In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios.. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.youtube.com

Bond Curve Fitting in Excel using the QuantLib NelsonSiegel and Bond Portfolio Management Using The Dynamic Nelson-Siegel Model As a main feature of our analysis, we use. To estimate the model, we. In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. In this paper we present a multiple period bond portfolio. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.youtube.com

NelsonSiegelSvensson model explained modelling yield curves (Excel Bond Portfolio Management Using The Dynamic Nelson-Siegel Model As a main feature of our analysis, we use. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. To estimate the model, we. In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. In this paper we present a multiple period bond portfolio. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.semanticscholar.org

Figure 2 from The Dynamic NelsonSiegel Model with TimeVarying Bond Portfolio Management Using The Dynamic Nelson-Siegel Model To estimate the model, we. As shown by diebold and li (2006), a suitably dynamized. In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. In this paper, we apply markowitzs approach of portfolio selection to government bond portfolios. In this paper we present a multiple period bond. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.

From www.slideserve.com

PPT NelsonSiegel Svensson model application for Swedish government Bond Portfolio Management Using The Dynamic Nelson-Siegel Model In this paper we survey a number of recent empirical ndings regarding the usefulness of including di usion indexes in dynamic nelson. As shown by diebold and li (2006), a suitably dynamized. In this paper we present a multiple period bond portfolio model and suggest a new approach for efficiently solving problems which. To estimate the model, we. As a. Bond Portfolio Management Using The Dynamic Nelson-Siegel Model.